Beneficiary of the company:

how to identify the shadow owner of the business?

28.02.2026

It's no secret that in addition to the management and participants (shareholders), in many companies there

is

a so-called "business owner", or beneficiary (ultimate beneficiary).

In tax law, in the field of combating money laundering, the beneficiary is a role in the corporate

structure,

it is actually identified with the company itself.

In bankruptcy cases in Russia, the word "beneficiary" is used as one of the synonyms of the person

controlling

the debtor. As a result, the beneficiaries bear secondary liability on an equal basis with the management

and

shareholders of the debtor, with the only difference that the beneficiaries often have assets that can be

foreclosed.

Fearing the negative consequences of their status, beneficiaries are interested in hiding their connection

with the company and take measures to remain in the shadows - they hide behind other companies, powers of

attorney, chains of transactions, foreign jurisdictions.

Who is the beneficiary and how to establish them?

According to the legal definition, a beneficial owner is an individual who directly or through third

parties owns a company (more than 25% in the share capital) or has the ability to control its actions on

other grounds.

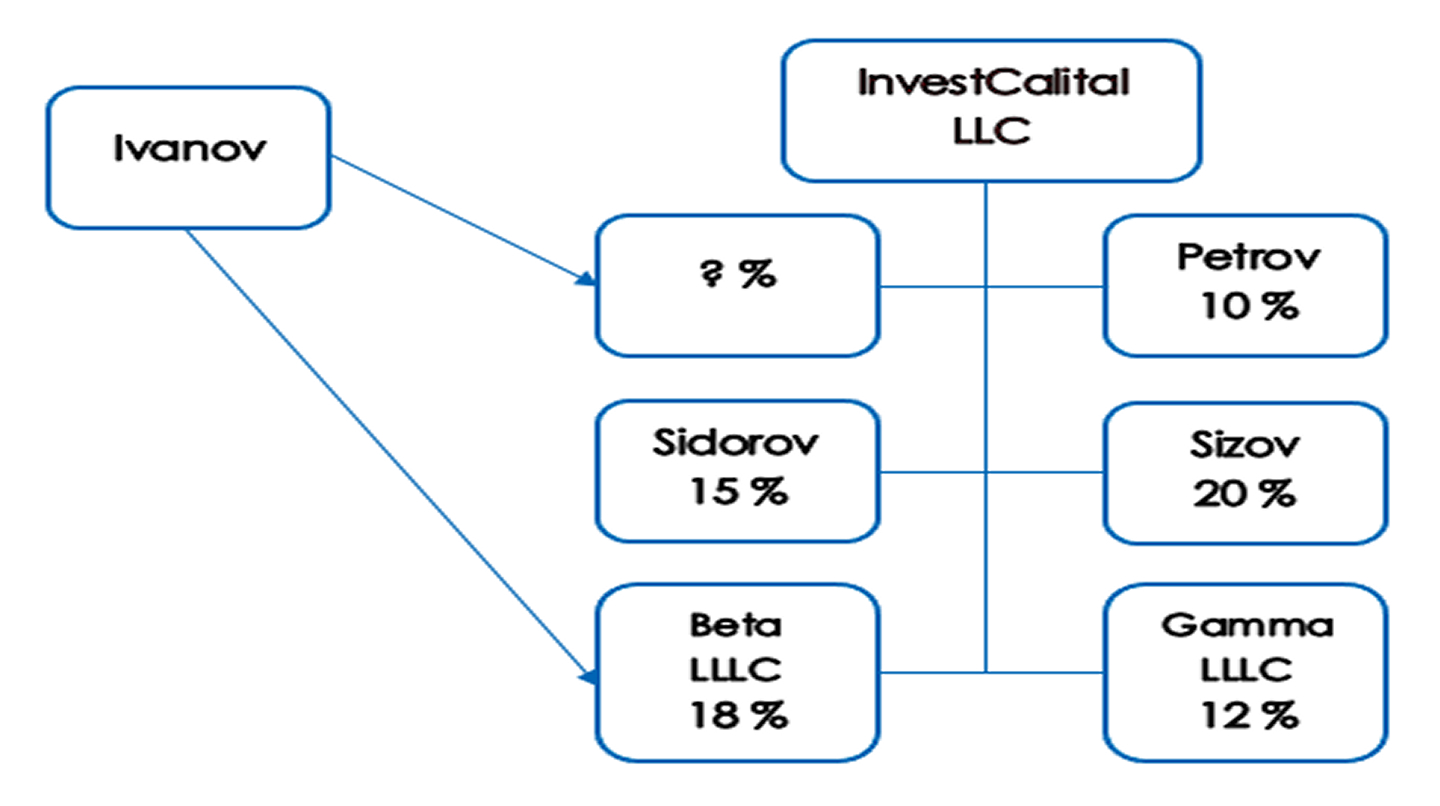

Let's consider the example of InvestCapital LLC.

Ivanov is a beneficiary of InvestCapital LLC (the Company) if:

- Ivanov owns 25% in the Company.

- Ivanov owns 15% in the Company and 100% in Beta LLC - in total, he owns 33% in the authorized

capital of

the Company.

- Ivanov owns less than 25% of the Company, but under a corporate agreement or power of attorney, he

has the

right to dispose of the votes of other members of the Company.

- Ivanov has no share in the Company, but is a charge holder of shares in the Company with the right

to make

a profit, vote on loan agreements with Beta LLC and Gamma LLC (in the amount of 30%).

- Ivanov has no share in the Company, but controls it due to property dependence or personal

connections (he

finances the Company, has family ties with the Company's members).

- Ivanov has no share in the Company, but he determines the areas of activity and/or controls current

activities (coordinates transactions, gives instructions to employees).

Indications of beneficiaries are given in the explanations of Russian state authorities, foreign,

supranational bodies ¹. These indications are also described in judicial practice.

For example, the Commercial Court of the Moscow Circuit in one of its cases stated that "the ultimate

beneficiary may be a former member of the board of directors who does not legally perform his duties to the

company, but actually retains the right to manage business activities and determine the strategic

development of the company" ²

The Supreme Court of the Russian Federation highlighted the signs of beneficiary's control over the debtor

³:

- Actions are synchronous without objective economic reasons;

-

The debtor's actions are contrary to its economic interests and lead to a significant increase in the

beneficiary's property;

-

The actions could not have taken place under any circumstances other than when there was control on the

part of the beneficiary.

Thus, in order to identify the beneficiary, it is necessary not only to study the corporate documentation,

but also to identify all the persons associated with it, assess the economic feasibility of the company's

actions, the use of assets, the choice of counterparties and behaviour in the process of concluding and

executing contracts.

¹ Information Letter of Rosfinmonitoring dated 04.12.2018 No 57, Letter of the Federal Tax Service

dated

16.08.2017 No SA-4-18/16148@, Recommendations of the International Financial Action Task Force on Money

Laundering (FATF GAFI) dated 2014 No 24 and No 25, para. 12, 13 of EU Directive No 2015/849/EU.

² Resolution of the Commercial Court of the Moscow Circuit dated 26.12.2016 case No

А4056167/2016.

³ Ruling of the Supreme Court of the Russian Federation dated 15.02.2018 No 302-ES14-1472.